Why Lucid (LCID) Speculators are Sounding the Short-Squeeze Alarm

/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

It’s no secret that electric-vehicle manufacturer Lucid Group (LCID) is a mess. Sure, since hitting an apparent near-term bottom on Sept. 4, LCID stock has jumped 26%. But that’s not going to get rid of the bad taste stemming from the year-to-date loss of roughly 33%. What’s more, in the trailing five years, LCID has stumbled over 79%.

When Lucid first entered the EV fray, it potentially offered viable competition to Tesla (TSLA). While the latter had become synonymous with next-generation mobility, its vehicles suffered from an unchanging design motif. With Lucid, the brand brought in much-needed dynamism to the ecosystem. Unfortunately, a fading rate of growth and expanding losses haven’t endeared Lucid to investors.

Subsequently, LCID stock is one of the ugliest securities in terms of technical resilience. Right now, the Barchart Technical Opinion indicator rates LCID as an 88% Strong Sell — not exactly a ringing endorsement. And while I’m not too big on so-called expert ratings, Wall Street analysts rate shares as a Hold.

Basically, nobody wants to outright say LCID stock is a “sell” for diplomatic reasons. However, out of 14 analysts, only two rate it positively (interestingly, both as a Strong Buy).

For arguably most investors, the kicker is the extremely high short interest against LCID stock, which stands at 30.64% of its float, per Fintel. Also, the short interest ratio clocks in at 5.41 days to cover, which effectively means that bearish traders will need over an entire business week to fully unwind their short exposure.

If that wasn’t enough, the off-exchange short volume ratio clocks in at 61.31%. While analyzing alternative trading systems or dark pools is extremely difficult business, the elevated off-exchange metric suggests that the pros are among the most skeptical of LCID stock.

So far, they’ve been right — but the diminishing returns on the short side may imply a possible sentiment reversal.

LCID Stock is a Stand-In for an Enticing Lottery Ticket

To better appreciate the power of the contrarian pull of elevated short interest, you must understand that a true short position is inherently a credit-based transaction. This means that there’s a contractual obligation tied to the underwritten risk being fully realized. A debit-based bearish strategy, on the other hand, has already paid the principal upfront.

Let’s consider the anatomy of a short transaction. Unlike a “regular” trade where an investor initiates a position by buying to open, a short speculator sells to open. These shares were initially borrowed on credit from a broker. Irrespective of whatever happens to the targeted security, then, the broker must be made whole.

If the short trade is successful for the bear, the underlying security collapses post-sale. Later, the speculator buys back the borrowed amount of shares (at a discount relative to the original sale price) and returns them to the lending broker. The difference is pocketed as profit. However, if the stock moves in the “wrong” direction (as in up), the speculator has a difficult choice to make.

Essentially, the prudent bears can cut their tail risk — or the aforementioned threat of an obligatory payment tied to risk realization — early. Stubborn ones risk getting their portfolios blown up. Many, if not most short traders panic out of their positions, which require buy-to-close transactions.

The end result? A classic short squeeze.

Now, what’s interesting about the bears’ relationship with LCID stock is that earlier transactions have been tremendously successful. Consider the following facts:

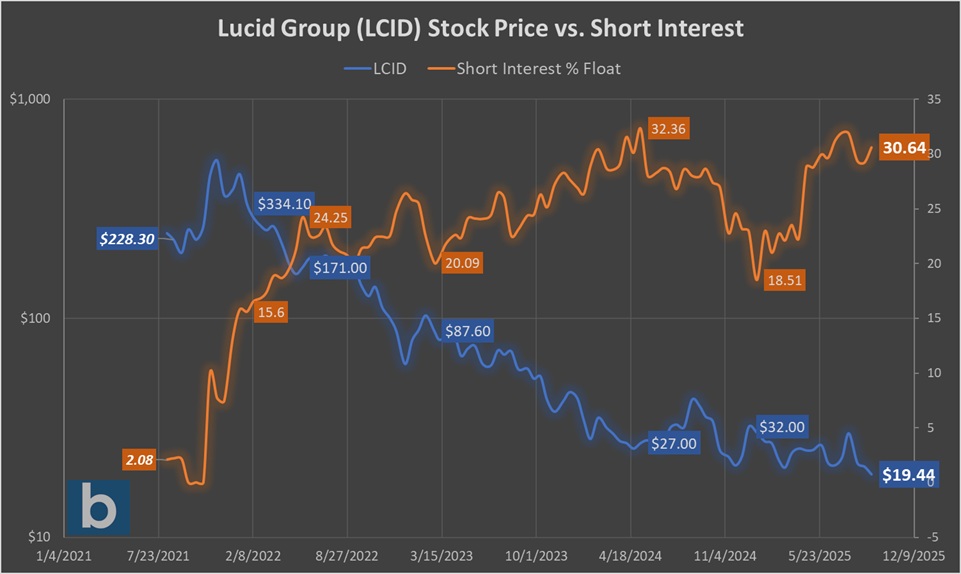

- Between Jan. 26, 2022 to May 24, 2022, LCID’s short interest jumped from 15.6% to 24.25% (a 55.45% gain in magnitude).

- During this same time period, LCID stock fell from $334.10 to $171, a drop of 48.8%.

- Between Feb. 27, 2023 to May 9, 2024, short interest soared from 20.09% to 32.36% (a 61.08% magnitude lift).

- During this time, LCID stock declined from $87.60 to $27, a 69.2% plunge.

However, in the latest spike near the beginning of this year to early September, short interest popped from 18.51% to 30.64%, a 65.53% magnitude difference. But during the same frame, LCID stock declined from $32 to $19.44.

Certainly, a 39.25% erosion is steep. However, the increased short exposure has not yielded a greater reward for the bears. With more traders apparently piling into the short trade, LCID stock genuinely risks a contrarian response.

How to Approach Lucid Group

While an explosive short squeeze is certainly one of the possibilities for LCID stock, such events are incredibly difficult to predict. Lucid is additionally problematic because of the lack of trading data. Sure, I pulled up three instances of comparative analysis. Still, I wouldn’t call that pound-the-table, confidence-inspiring research.

Let’s just be brutally honest — LCID stock is a gamble, straight up. At this moment, I’m simply unaware of any reliable methodology to predict how a potential short squeeze may materialize. That said, given that Lucid is one of the most heavily shorted securities, taking a contrarian bet (on the debit side) may not be a bad idea.

Therefore, if you have some loose change, I wouldn’t be opposed to throwing some funds you can afford to lose at LCID stock. For those with a true speculative bug, you may consider long-expiry out-the-money calls.

Heck, with the diminished returns on the short side, I just might join you.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.